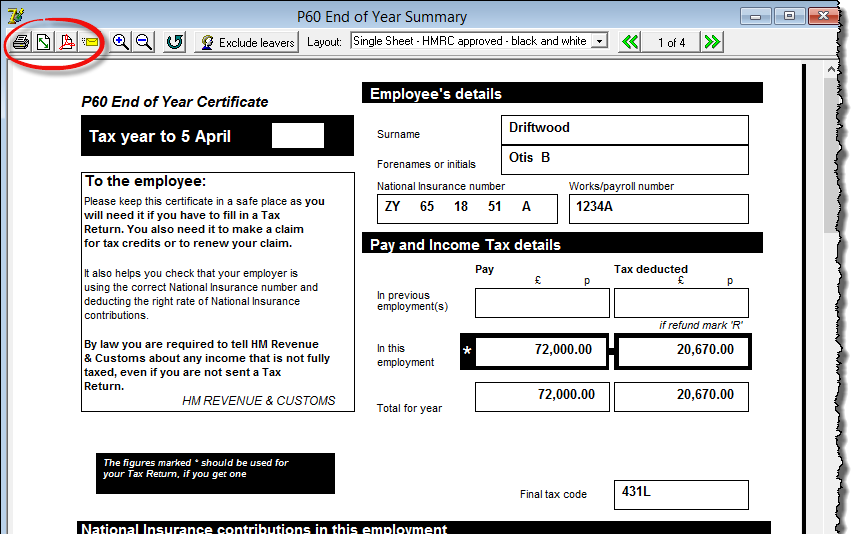

HMRC P60 FORMS TO DOWNLOAD

If you receive a salary from other sources, you should get a P60 from your employer s. P60 sample P60 sample. Where cumulative basis applies, the total pay and tax from all employments for should be entered on the P60 at Sections A 1 and B 1 respectively. Create, send and store sole trader invoices in a snap with our free invoice software. The pay and tax figures entered on the P35L are the combined pay and tax figures for all periods in that year. You can check how much tax you paid last year if you think you might have paid too much.

| Uploader: | Vudoshakar |

| Date Added: | 1 July 2007 |

| File Size: | 36.47 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 14955 |

| Price: | Free* [*Free Regsitration Required] |

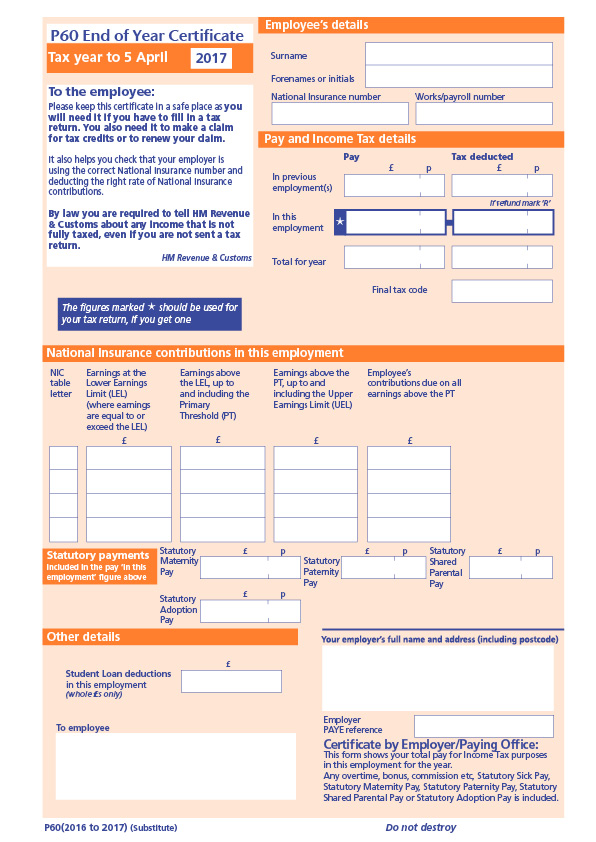

The pay and tax entries required on the P60 are slightly different to the entries required on the P35L. What is a P60? USC for all employments should be entered at D 1 and E 1. End of year certificate P60 Note is the final year that you will issue a P60 to employees.

An employee may have worked for you a number of times during the tax year. Useful tools and resources. You should copy this from their payroll record. It looks like the internet browser you are using is out of date.

Completing the P60 pay and tax figures Your employee may have worked for you for more than one period during the year. If they left before 31 December they should not get a P Your employee may require a statement of the amount of pay earned in the year rather than the amount actually paid. Reclaiming any overpaid Income Tax or National Insurance Applying for anything means-tested, such as tax credits Completing a Self Assessment return Applying for loans or mortgages.

From understanding expenses to starting a limited company, we've a range of jargon-free business guides for you to download and keep. The forms must then be provided to your employees by 31st May the same year.

Business guides From understanding expenses to starting a limited company, we've a range of jargon-free business guides for you to download and keep. Your employer will need to work out how much tax you should be paying on your salary. To find out more about formss and how we use them, please see our privacy policy.

Build your own online accountancy package Join 11, clients who trust our advice, support, and leading accountancy software for their business.

End of year certificate (P60)

Any data collected is anonymised. In most cases, your accountant will do this for you.

To help us improve GOV. You can check how much tax you paid last year if you think you might have paid too much. If you receive a salary from other sources, you should get a P60 from your employer s.

End of year certificate (P60)

It helps your employer work out your correct tax code before your first payday. By continuing to browse the site you are agreeing to our use of cookies.

See how we can help you. In this case you must enter the pay figure for the latest period at Section A 3 of the form. Get ready for Brexit. The free community for the self-employed You'll get access to a range of benefits, such as invoice software, jargon-free business guides, great networking opportunities, discounts, plus much more.

HM Revenue & Customs: Online forms Ordering

Why do I need one? UK uses cookies which are essential for the site to work. Dorms topics What are gross pay and taxable pay? Is this page useful?

Choose exactly what accountancy support you need with our new tool and get a quote in 60 seconds. The 'date of commencement of employment' entered on the P60 is the date from the latest period of employment: What if I use an umbrella company?

The pay and tax figures entered on the P35L are the combined pay and tax figures for all periods in that year.

Comments

Post a Comment